Franchise head offices have a significant impact on the strength of the entire franchise group. To ensure everything is operating at its best and most profitable, franchise head offices need to look at their payment tools and systems.

Fintech innovations are giving businesses powerful ways to improve their payment processes, resulting in faster payment times, happier customers and reduced financial risk. And in a franchise network, where the success of your business owners are core to your success, giving your network more ways to pay can propel their growth and, in turn, improve the financial, operational and strategic performance of head office.

In this article, we discuss how franchise head offices can get paid faster by providing flexible payment options and integrated payments to their franchisee group.

Provide payment flexibility to your franchise stores

As outlined in a recent white paper, Flexibility in B2B payments: How an improved customer experience generates more sales, providing flexible payment options to customers not only creates a better customer experience but it also boosts cash flow across the supply chain. Whether it’s for regular payments or one-time invoices, introducing the infrastructure to your head office to accommodate a range of payment options will strengthen your network.

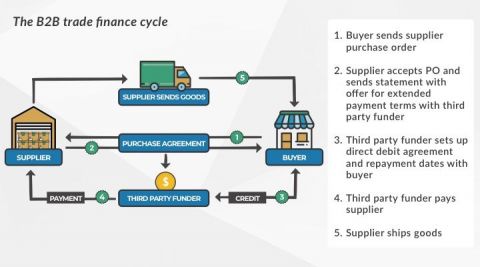

Key Business to Business (B2B) payment options that are transforming the B2B payment landscape are Buy Now, Pay Later (BNPL) services and an increased acceptance of credit card payments. B2B BNPL transactions work in a similar fashion to B2C transactions. You get paid upfront, meanwhile, franchisees will have the option to to pay their invoices on a pre-selected date.

For new business owners, BNPL options are particularly helpful as the business may not have a strong enough balance sheet to meet the lending requirements in traditional finance channels. Similarly, credit card payments can reduce the likelihood of late payments to your head office while giving your franchisees more time to pay their invoice due to the interest-free period on credit cards.

Introduce infrastructure that gives business owners access to non-bank lending

With an integrated payment infrastructure such as Spenda, your head office can give business owners access to on demand Non-Bank Lending (NBL). This provides franchisees with more ways to access the finance they need to continue improving and growing their businesses. Providing access to NBL can allow businesses across the network to secure finance for projects such as refitting stores and placing larger purchase orders.

Integrate your payment, ERP and accounting systems

Many Australian businesses have experienced the pressure and time-consuming nature of chasing late payments. It’s estimated that Australian businesses spend about 12 days per year following up debtors. Even if you have a dedicated accounts receivable team who has the time to chase late payments, automation can make this process more efficient and create the time to focus on more strategic work. Not only can integrated payment systems make your customers happy, but it may result in happier employees too.

With the functionality to integrate with major accounting software and ERP management systems, Spenda provides an e-invoicing platform that will enable your business owners to log in, view and pay their invoices in one place. They’ll enjoy the efficiency of seeing their bills in one portal, while your head office team can do the same — easily see the status of your accounts payable and receivables and the health of each franchisee’s account. And with ledger-to-ledger postings, transactions are updated in real time for both parties.

As a result, you’ll benefit from automated data entry with reduced errors, more accurate account reconciliation and reporting, time and cost efficiencies, and a more secure payment environment.

Strengthen your franchise network with Spenda

Spenda’s payment features allow franchise head offices to transform their payments through integration, a range of flexible payment options and robust systems that generate stronger cash flow. Our tools are designed to be user-friendly, efficient and powerful to make your head office more strategic and efficient while giving business owners the cash flow and capital they need to be successful.

Want to learn more about new innovations that are shaping the future of B2B payments and boosting cash flow management for Australian businesses? Download your free whitepaper copy HERE.

*This article is for general information purposes only. Consult a qualified financial advisor regarding any changes to or decisions about your business’s finances.